dekalb county tax assessor address

Homestead Exemption is a savings allowed for property owners who own and live at their primary residence. If you enter only a Street Number of 100 all parcels that contain 100 in the Street Address will display in the Search Results.

Dekalb County Tax Commissioner S Office Linkedin

On Tuesday the.

. DeKalb County Tax Commissioner. DeKalb County residents can sign up to receive Property Tax statements by email. View Property Tax Information.

In order to achieve this goal the Chief County Assessment Office serves the resident taxpayers of DeKalb County with assessing their property value in accordance with the Property Tax Code 35ILCS200. You can visit their website for more information regarding property appraisal in DeKalb County. Search by Property Address.

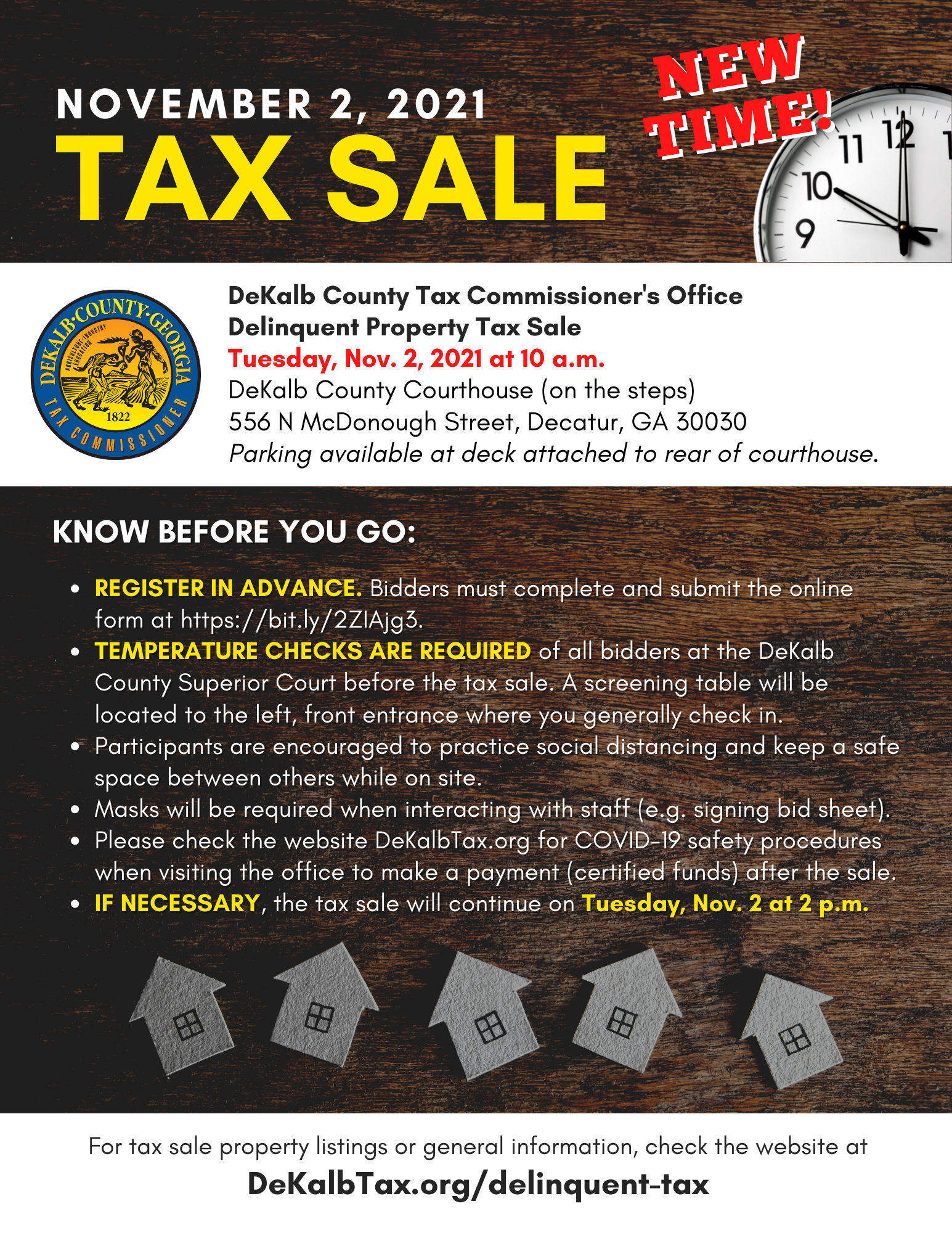

DeKalb County Tax Commissioner Motor Vehicle Division PO. The original 2022 Personal Property Tax Return andor Freeport Application you received had the incorrect return address for the Dekalb County Property Appraisal Office. If a tax sale is scheduled an auction of the property taxes is conducted in front of the DeKalb County Courthouse the first Tuesday of the month.

Individuals applying for the first time must own and occupy the home as their primary residence as of January 1 have all vehicles registered in DeKalb County and not have a homestead exemption anywhere else. The DeKalb County Board of Assessors is the agency charged with the responsibility of establishing the fair market value of property for ad valorem taxation purposes. Vernor is Chairman Emeritus and Associate Professor Emeritus of Real Estate at Georgia State University where he was a full-time faculty member from 1974 through 1997 teaching real estate appraisal finance investments and market research.

DeKalb County Property Appraisal. SW Fort Payne AL 35967 Phone. Our website will post listings of the properties included in the sale.

The DeKalb County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within DeKalb County and may establish the amount of tax due on that property based on the fair market value appraisal. Chief County Assessment Officer. The Assessor provides the following services.

Legal tax sale hours are from 9am to 4pm. Personal Property businessfarm mobile homes recreational vehicles. DeKalb County Assessors Office Services.

Presently the members of the Board are Chair. ANGOLA It will be more convenient to appeal a property tax bill with new software being deployed by the Steuben County Assessors Office. Vernor Secretary Calvin C.

Hicks Jr Chief Appraiser 404 371-2468 404 687-7143 Fax cchicksdekalbcountygagov. You may also contact the Property Appraisal office at 404 371-0841. Box 100025 Decatur GA 30031-7025.

Property Taxes are collected for. Johnson has held several positions within the tax office including supervisor and manager level positions over the past 21 years. Decatur GA 30030.

Under the leadership of Tom Scott deceased and his successor Claudia Lawson Mr. You may type one or the other. Main Partial Owner Name eg.

123 main Partial Street Name or eg. Property Tax DeKalb County Tax Commissioner Property Tax Division PO. Homestead Exemption is a savings allowed for those property owners who own and live at their primary residence.

Estate settlement inheritance schedule for beneficiaries transfer of personal property and financial assets. Dekalb County Assessor 109 W Main St PO Box 77 Maysville MO 64469 Voice. Real Estate new construction change to or removal of improvements.

Maintain Tax Assessment Records for County. The correct return address is below. 19 hours agoProperty tax appeals going online soon.

James Doyle Vernor PhD MAI is serving as the 2017 Vice-Chair of the DeKalb County Board of Assessors. You do not have to enter both a Street Number and a Street Name. Compass DeKalb County Online Map Search.

Staff contact information is provided for your convenience. Box 100004 Decatur GA 30031-7004. At this site users can view property information pay property taxes for the current tax year apply for the basic homestead exemption make address changes view tax sale information apply for.

The Property Appraisal Department is responsible for the appraisal and assessment of property. Johnson joined the DeKalb County Tax Commissioners Office in July 2000 as a Network Coordinator. Last name to perform a search on Property Information within DeKalb County.

For more information about property tax bills select Tax Bill Information under Property Tax. Search for the property record and click the link underneath the Pay Now button. WEdge -DeKalb County Property Tax Inquiry and Property Tax Payments.

Tax Sale New Time Dekalb Tax Commissioner

Dekalb County Tax Commissioner S Office Dekalbtaxga Twitter

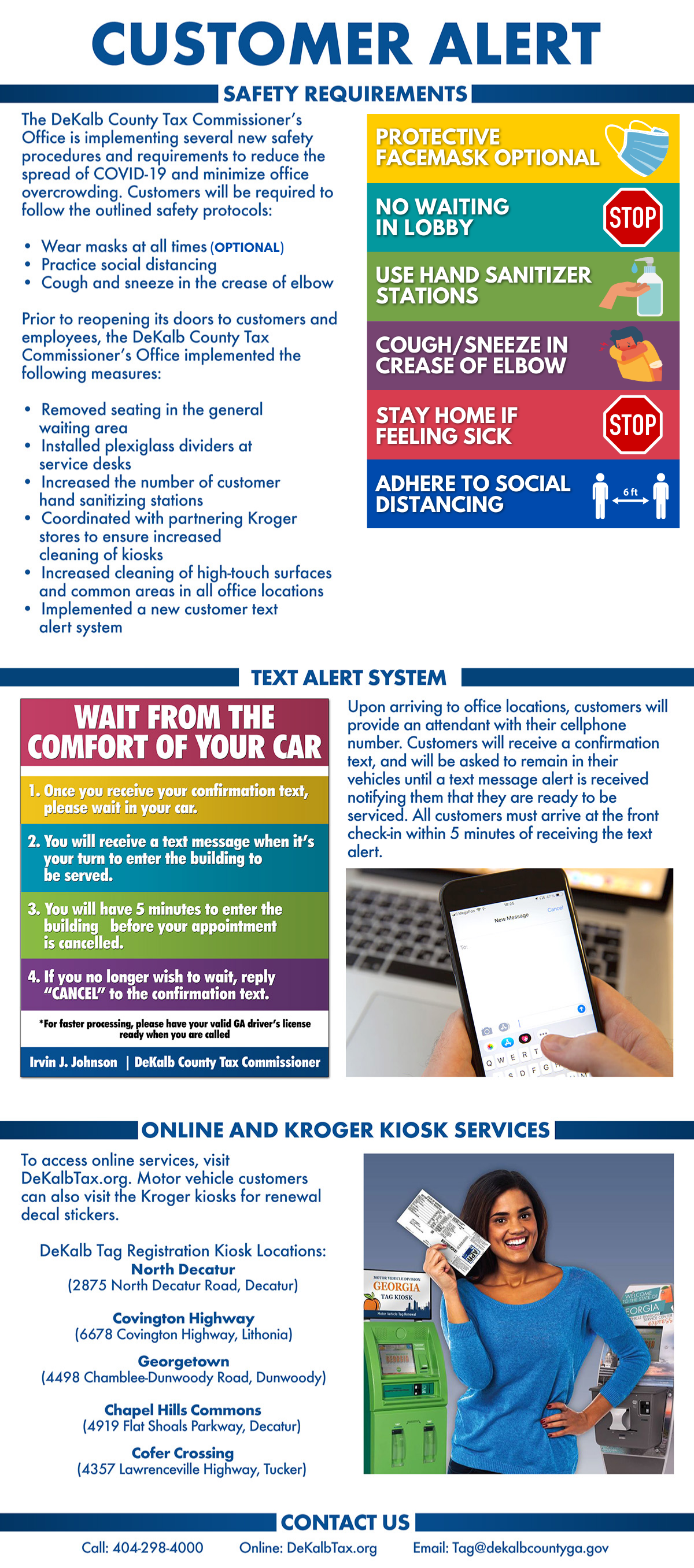

Covid 19 Customer Alert Dekalb Tax Commissioner

Accounting And Tax Preparation Stone Mountain In 2022 Debt Resolution Accounting Services Tax Preparation

Dekalb County Tax Commissioner Reminds Property Owners Of First Installment Deadline Encourages Online Payment Before Sept 30 On Common Ground News 24 7 Local News

Click2skip Dekalb Tax Commissioner

Tax Sale Dekalb Tax Commissioner

Dekalb County Tax Bills Mailed Dekalb Tax Commissioner

Dekalb County Tax Commissioner S Office Avoid The Wait Click2skip With Just Two Simple Steps Appointments Are Currently Available At Our Memorial Drive Location Visit Dekalbtax Org To Schedule Your Motor Vehicle

Property Tax Dekalb Tax Commissioner

Property Tax Dekalb Tax Commissioner

Dekalb Announces Proposed Property Tax Increase Dekalb County Ga