what is a secondary property tax levy

PIMA COUNTY FISCAL YEAR 202223 TAX LEVY. A tax levy is the amount specific in dollars that a taxing unit city town township etc may raise each year in property tax dollars.

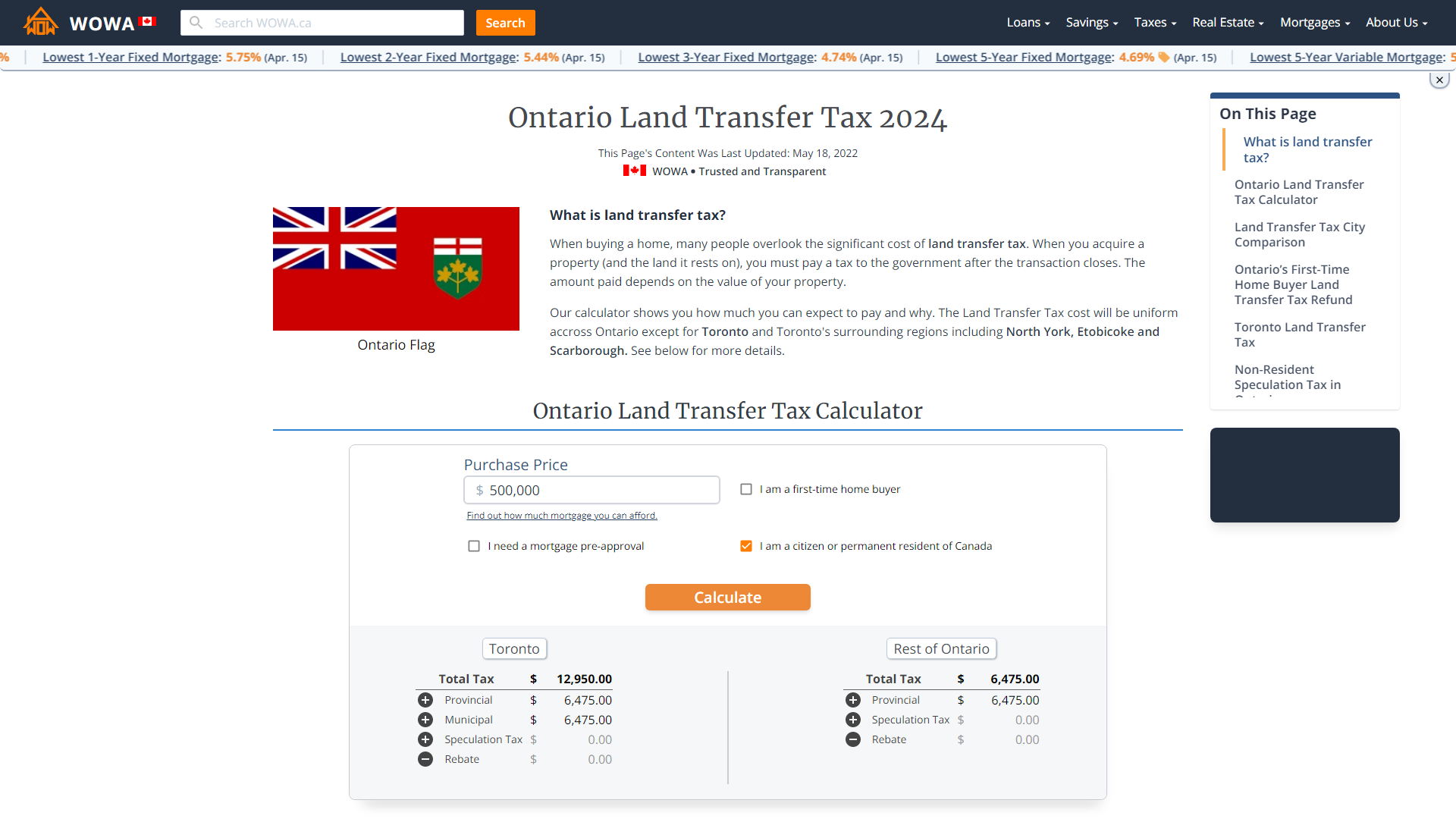

Ontario Land Transfer Tax 2022 Calculator Rates Rebates

A levy is a legal seizure of your property to satisfy a tax debt.

. 2 days agoThe levy which would total 2023 million for 2023 would amount to a 231 property tax increase for the owner of a median-value home which is 261800 according to. A property tax levy is the right to seize an asset as a substitute for non-payment. Arizona Property Tax and School Equalization Tax are.

Secondary Tax Rates are used to fund such things as bond issues budget overrides and special. Towns and cities use the proceeds from levying property taxes to fund. What is an assessed value.

Under state law cities and towns are allowed to levy a secondary property tax for the sole purpose of retiring the principal and interest on. Property taxes are one of the primary if not the only ways for municipalities to raise revenue for community services. A tax levy is a collection procedure used by the IRS and other tax authorities such as the state treasury or bank to settle a tax debt that you owe to them.

Levy Limits Homeowners Rebate Tax Deferral Exemptions. A lien is a legal claim against property to secure payment of the tax debt while a. Credit reporting agencies may find the Notice of Federal Tax Lien and include it in your credit report.

The City uses the tax levy not the tax rate to. The secondary tax is comprised mainly of commitments to satisfy bond indebtedness of jurisdictions fund voter-approved budget overrides and to support the operations of the. 301 West Jefferson Street Phoenix Arizona 85003 Main Line.

The City collects a secondary property tax which is used to pay the principal and interest due for debt associated with General Obligation Bonds. Secondary Property Tax Levy debt repayment. The Tax System is available for credit card and debit card payments.

Secondary Tax Rates are used to fund such things as bond issues budget overrides and special district funding. Secondary property taxes 1 Current years levy 1666442 2 Prior years levies 29660 3 Total secondary property taxes 1696102 C. To help inform the discussion here are some answers to frequently asked questions.

Secondary property taxes are levied to pay principal and interest on bonded indebtedness. A levy is a legal seizure of your property to satisfy a tax debt. Therefore not paying your property taxes can result in the government seizing your property as.

An IRS levy permits the legal seizure of your property to satisfy a tax debt. Paul Mayor Melvin Carter is proposing a 15 percent hike in the citys property tax levy in his 2023 budget. Credit reporting agencies may find the Notice of Federal Tax Lien and include it in your credit report.

In other words the levy is the cap on the amount of property. Levies are different from liens. Property Taxes Search andor Pay Property Tax On-line To start a search choose the Property Tax button on the top left.

Visit the Treasurers home page to view important announcements and tax bill information. A levy is a legal seizure of your property to satisfy a tax debt. Search the history of tax bills for your property.

Comprised of the total of the obligation for Special Taxing Districts voter approved bonds and budget overrides that are assessed on valuation. About half that jump comes from a change in how the city pays for. A tax rate is figured by dividing the total secondary property tax levy by the total assessed value in town to determine each property owners share of the levy.

Secondary Property Tax SEC.

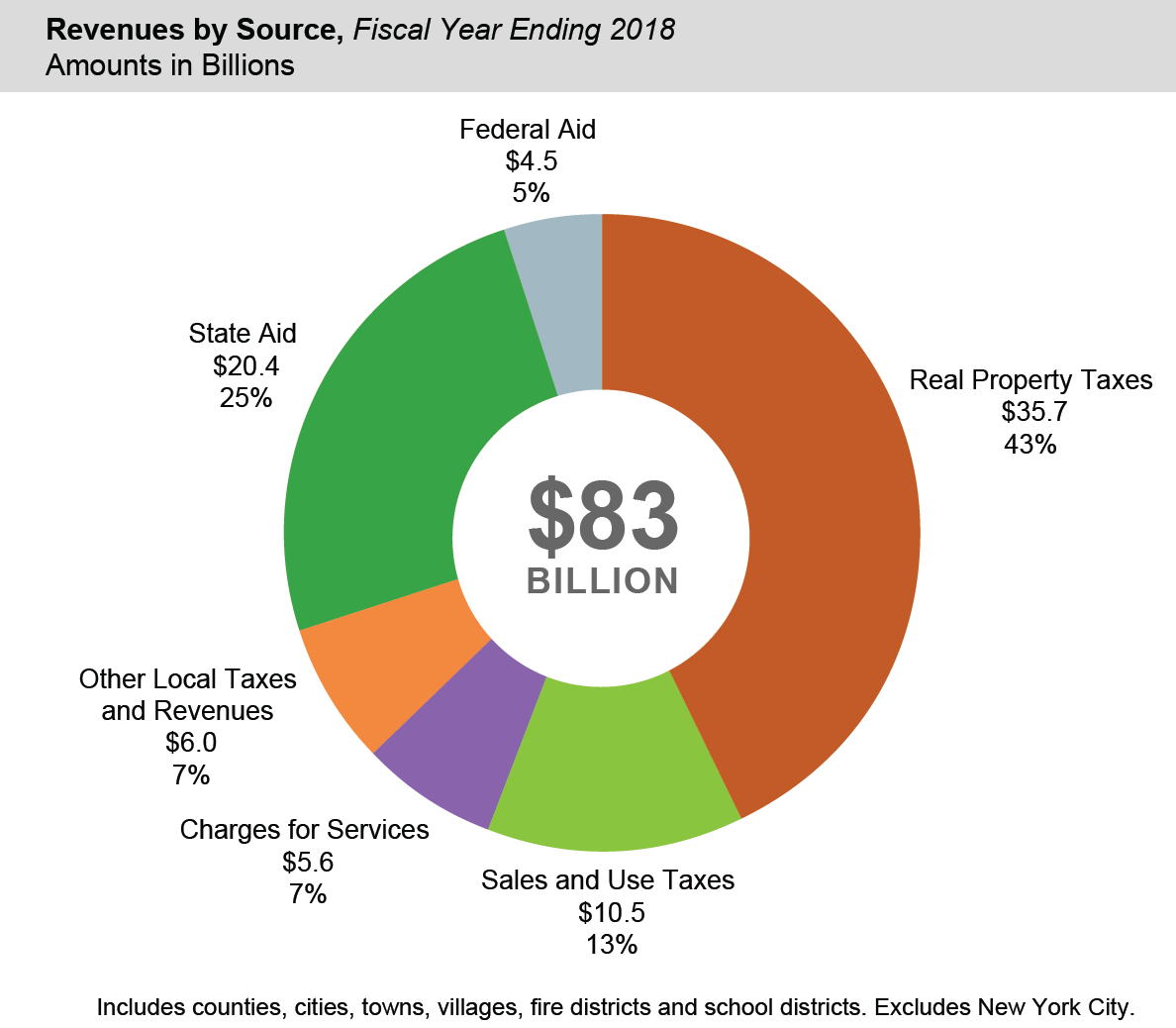

Local Government Office Of The New York State Comptroller

Part 1 General Principle Docx 2 Part 1 General Principles Mutiple Choice Choose The Correct Studocu

Tax Collector Stock Illustrations 342 Tax Collector Stock Illustrations Vectors Clipart Dreamstime

Langford Property Tax Due July 2 Island Social Trends

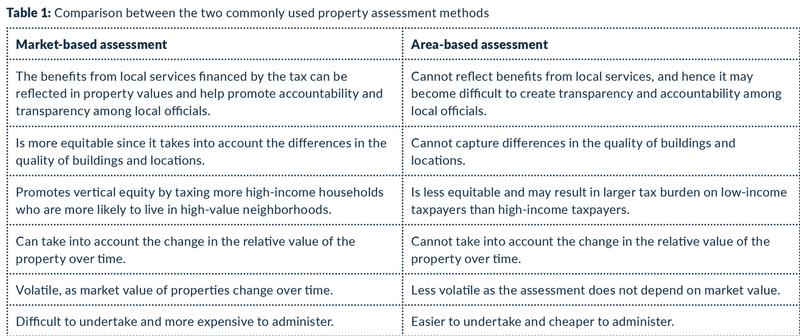

Property Taxation In Developing Countries

Langford Property Tax Due July 2 Island Social Trends

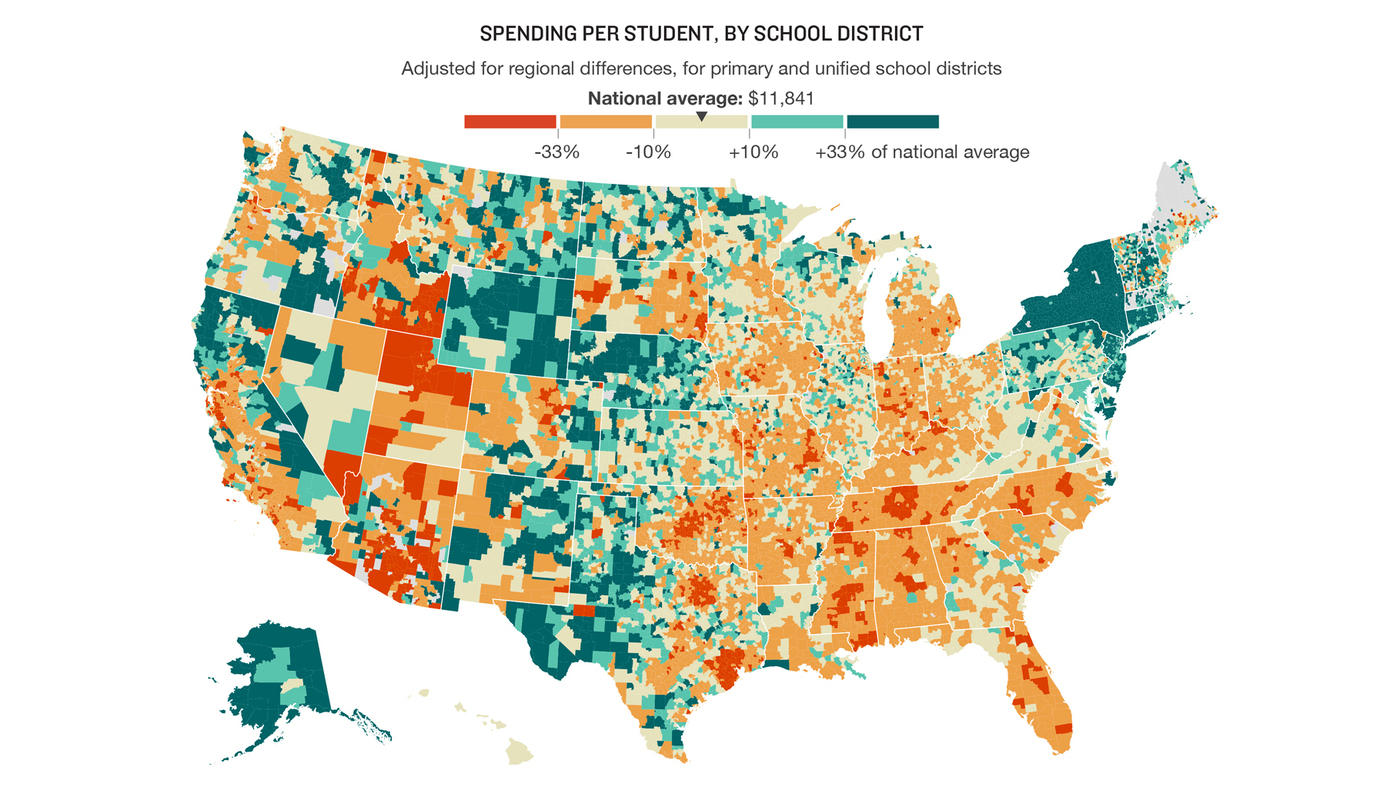

How School Funding S Reliance On Property Taxes Fails Children Npr

Halton Hills Property Tax 2021 Calculator Rates Wowa Ca

.jpg)