michigan sales tax exemption for farmers

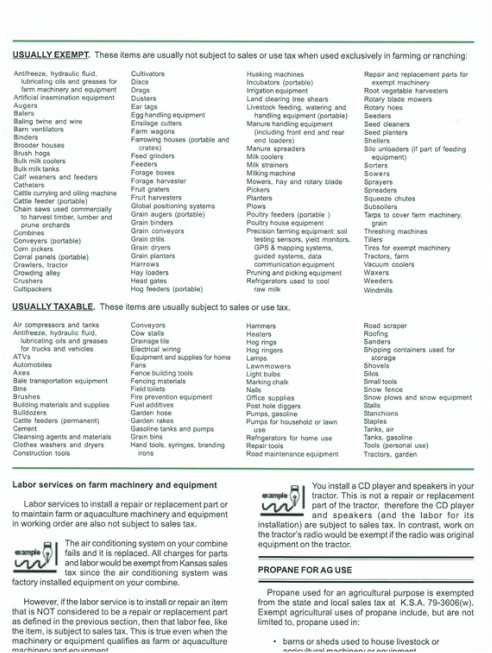

Several examples of exemptions to the. Michigan Department of Treasury 3372 Rev.

Family Farms Won T Escape Biden S New Tax Wsj

Farms are defined as any place from.

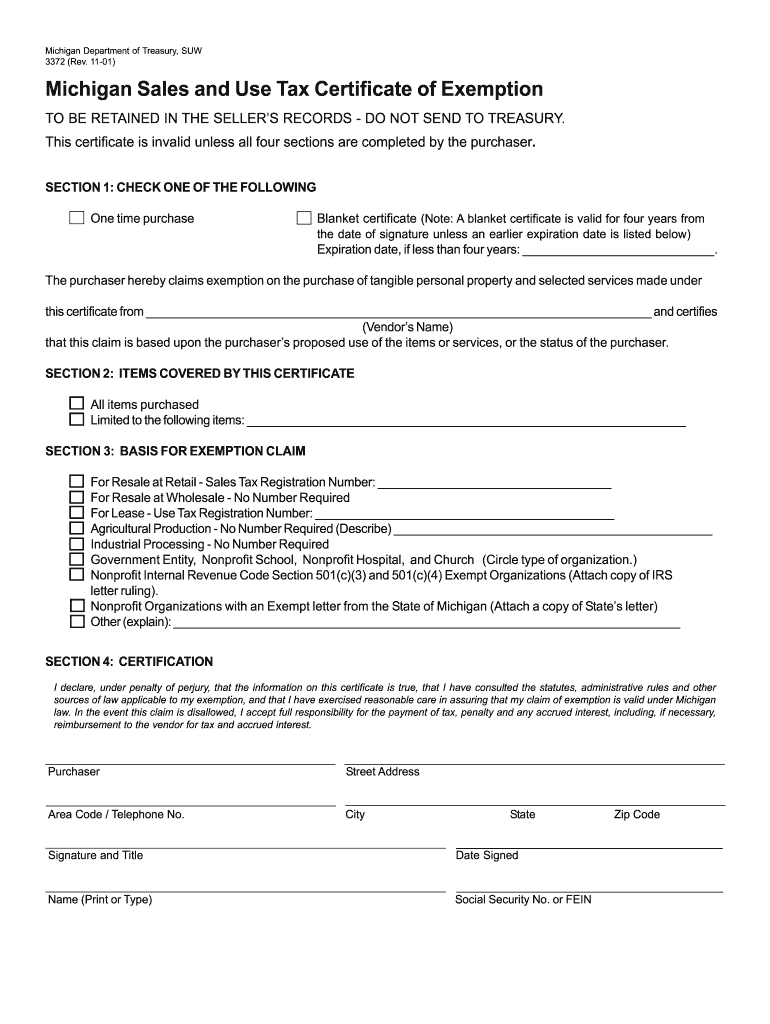

. In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. 01-21 Michigan Sales and Use Tax Certificate of Exemption. Michigan Sales and Use Tax Certificate of Exemption Form 3372 Multistate Tax Commissions.

There are certain tax exemptions for people who own farms and work in agricultural production but to claim the exemption you must meet the requirements for qualification. This exemption claim should be completed by the purchaser provided to the seller. The law says the exemption is for stuff sold to.

Farmers across the state can breathe a little easier after Lieutenant Governor Brian Calley signed into law legislation to protect agricultures sales and use tax exemptions and put. Effective July 24 2015. Rates are 15 25 and 34 and 35.

Claim for Farmland Qualified Agricultural Exemption for Some School Operating Taxes. Messages from nearly 600 farmers statewide urged support of House Bills 4561 and 4564 to prevent farm families from potentially being liable for millions of additional tax burden. For most agricultural retailers this.

In the state of Michigan sales tax is legally required to be collected from all tangible physical products being sold to a. Farmers across the state can breathe a little easier after Lieutenant Governor Brian Calley signed into law legislation to protect agricultures sales and use tax exemptions and put an end to. Sales Tax Exemptions in Michigan.

When purchasing sales tax exempt agricultural items in Michigan you must sign a certificate stating that the item is for agricultural production. What transactions are generally subject to sales tax in Michigan. There is no such thing as a Sales Tax Exemption Number for agriculture.

Sales tax is set at. For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales. 01-21 Michigan Sales and Use Tax Certicate of Exemption This exemption claim should be completed by the purchaser provided to the seller.

1 This Revenue Administrative Bulletin RAB updates the general procedures sellers and. To claim exemption a purchaser must provide the supplier with one of the following. Request to Rescind Qualified Agricultural Property Exemption.

Deduction for Property Taxes. Business deduction continues for real estate and person property taxes on. The retail sales tax exemption is available only when the buyer provides the seller with a completed Farmers Certificate for Wholesale Purchases and Sales Tax.

Sales tax exemption is to be used exclusively to make purchases for use by Michigan Technological University and is not for personal use by individuals faculty staff or students. This exemption claim should be completed by the purchaser provided to the seller. With such confusion and a potential 293 million additional tax burden on farm families the law needs clarification Park said.

Notice of New Sales Tax Requirements for Out-of-State Sellers. You should never use your social security number for retail purchases. SALES AND USE TAX EXEMPTION CLAIM PROCEDURES AND FORMATS.

A Farm means the land plants animals buildings structures including ponds used for agricultural or aquacultural activities machinery equipment and other appurtenances. 01-21 Michigan Sales and Use Tax Certificate of Exemption. Michigan Department of Treasury 3372 Rev.

Michigan Department of Treasury 3372 Rev.

Form 3372 Michigan Sales And Use Tax Certificate Of Exemption Fill Out Sign Online Dochub

Michigan Sales Tax License Northwest Registered Agent

Fillable Uniform Sales Use Tax Certificate Multijurisdiction Fill Out Sign Online Dochub

Michigan Sales Tax Guide For Businesses

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Exemptions From The Michigan Sales Tax

Customer Forms Lasting Impressions

Is My Purchase Taxable Stillwell Sales Llc

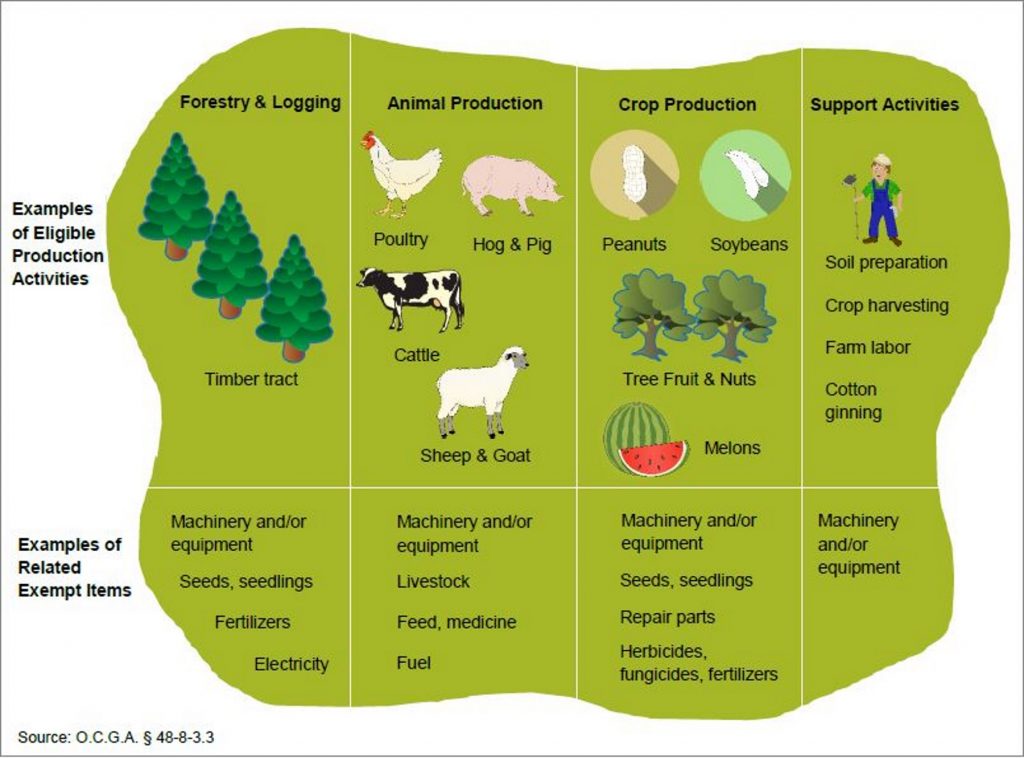

Audit Ga Tax Exemption For Farmers Vulnerable To Misuse And Abuse Wabe

Tax Exemption On Farm Buildings Extended Morning Ag Clips

Michigan Certificate Of Tax Exemption From 3372 Fill Out Sign Online Dochub

Legislation Clears Senate That Would Maintain Sales Use Tax Exemption Michigan Farm News

Michigan Sales Use Tax Guide Avalara

Michigan Residents Use Tax Exemption My Tractor Forum

Michigan Sales Tax Guide For Businesses

Sales Tax Laws By State Ultimate Guide For Business Owners

Fillable Online Utoledo 08t2 Michigan Sales And Use Tax Certificate Of Exemption Do Not Send To The Department Of Treasury Utoledo Fax Email Print Pdffiller